-

Second Annual Refinance Closing Costs Report Shows Mortgage Refinance Closing Costs Increased 3.8% in 2021

-

Comparatively, the closing costs of buying a mortgage increased by 13.4%

IRVINE, Calif., May 9, 2022–(BUSINESS WIRE)–CoreLogic’s ClosingCorp, a leading provider of residential real estate closing cost data and technology for the mortgage and real estate services industries, today released its second annual Closing Costs Report. closing of the refinancing for 2021.

This press release is multimedia. See the full version here: https://www.businesswire.com/news/home/20220509005114/en/

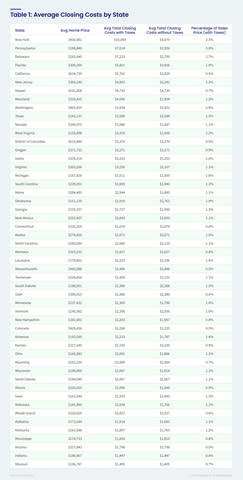

Table 1: Average Closing Costs by State (Chart: Business Wire)

Key points to remember

-

The national average closing cost for refinancing a single family home in 2021, excluding any type of registration or other specialty tax, was $2,375. While this amount is up $88, or 3.8%, from the reported amount of $2,287 in 2020, it still represents less than 1% of the average refinance loan amount, which was $304,909. .

-

In contrast, CoreLogic released its 2021 Procurement Closing Cost Report and said domestic closing costs average $3,860, excluding transfer and specialty taxes.

-

The main differences between average closing costs for refinances and home purchases are that homeowner’s title insurance and several common inspection fees for purchase transactions are generally not required for refinances. Yet most third-party fees, including lender title, settlement service, and surveying, were also lower for refinances.

“In 2021, homeowners could still get great deals on interest rates and closing costs,” said Bob Jennings, director of CoreLogic Underwriting Solutions. “Although refinancing closing costs have increased slightly, annual fee increases remain below the average inflation rate of 7% seen in 2021. Much of the cost containment can be attributed to the growing use of solutions technologies by lenders and settlement service providers, allowing the industry to increase capacity while controlling closing costs.”

State and Metro Takeout:

-

The 2021 report shows that the states with the highest average closing costs, excluding specialty taxes, were Hawaii ($4,730), New York ($4,679), Florida ($3,956), Texas ($3,588 $) and the District of Columbia ($3,370).

-

The states with the highest closing costs, including taxes, were New York ($10,084), Pennsylvania ($7,614), Delaware ($7,223), Florida ($5,821) and California ( $5,762).

-

At the metro level, those with the highest average fees without taxes include Key West, Florida ($4,922); Arcadia, Florida ($4,756) and Kahului-Wailuku-Lahaina, Hawaii ($4,651).

Refinance cost calculations include the lender’s title policy, appraisal, settlement, registration fees, and various state and local taxes. The calculations use home price data from CoreLogic to estimate closing costs for an average home at the state, Central Statistical Area (CBSA), and county levels. Ranges, rather than single values, are used to more accurately capture fees associated with actual transactions.

For more information on this data, or for the full report which offers additional detail, please visit fence.com/closingcosttrends.

Methodology

ClosingCorp’s average closing costs are defined as the average fees and taxes required to close a conventional refinancing transaction in a geographic area. These costs include fees for the following types of services: title policies (lenders only as homeowner’s policy does not apply to refinances), appraisals, settlement fees, registration fees, land surveys and taxes related to refinancing.

The actual closing costs for 4.99 million single family refinances from January 1 to December 31, 2021 have been analyzed. Average loan amounts have been estimated at 80% of average house prices (source: CoreLogic©, one of the world’s leading providers of property information, analytics and data). Homes within $100,000 of this estimated average loan amount were used to estimate closing costs for an average single-family residential home at the state, Central Statistical Area (CBSA), and county levels. .

The average Service Type Component Fee has been calculated for each geographic area where at least 10 transactions occurred within the specified range during the reporting period. The total closure cost was then calculated as the sum of the service type averages. Survey fees have only been included for single family homes in Florida and Texas where surveys are required. The cost of closing has been calculated with and without taxes.

About CoreLogic

CoreLogic, a leading provider of real estate information and solutions, promotes a healthy housing market and thriving communities. Through its enhanced real estate data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance companies, government agencies and other housing market players to help millions of people to find, buy and protect their home. For more information, please visit www.corelogic.com.

See the source version on businesswire.com: https://www.businesswire.com/news/home/20220509005114/en/

contacts

Robin Wacher

CoreLogic

[email protected]