There are never any guarantees in life, but there are ways to help you get the auto loan you need, even with bad credit. Steps to Ease Your Car Loan Problems Getting a car loan is something you need to be prepared for. Although the requirements you will need to meet will vary by lender, […]

Category Archives: Loan approval

If you are based in New Jersey, you are more likely to be approved for a small business loan. That’s according to a new report from Biz2Credit, which identified New Jersey as the best state for small business loan approval rates. The report found that nearly a quarter (23.4%) of financing requests made by New […]

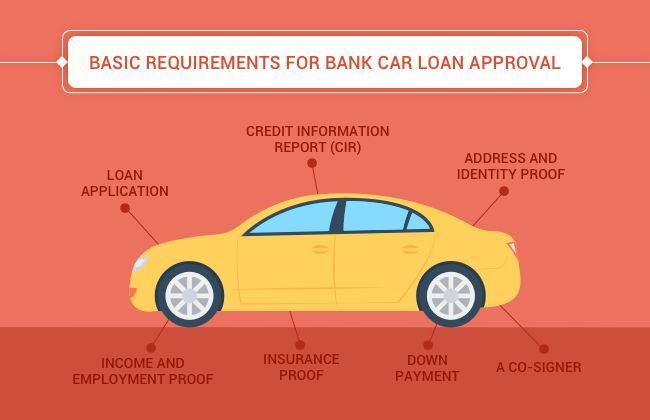

Just because of related myths, consumers generally overlook banks as a financing option when looking for an auto loan. Obtaining a car loan from the bank has become equally fast and economical. Financing your car through a bank benefits you in several ways, including a lower interest rate, saving money, longer repayment terms, and more. […]

NAB today officially launched a new, simpler, easier and more convenient way for customers to get conditional approval for a home loan. NAB goAHEAD allows NAB customers to request conditional approval for a new home loan online 24/7 and receive an instant response. “We save our clients time and stress, and help them bid on […]

It is possible for a consumer with bad credit to get approved for a car loan. These buyers normally only have to go through a dealer who works with special lenders. However, certain conditions must also be met for a borrower to qualify for a bad credit car loan.

The length of time it takes to be considered for an auto loan depends on the lender you work with. However, there are a few general guidelines that most subprime lenders stick to when it comes to approving an auto loan. If you have poor credit, job stability is a key factor in qualifying for […]

Many of our applicants and potential applicants want to know what their subprime auto loan approval amount will be before they even walk into a dealership. We are unable to tell them.

Big banks have long been accused of turning a blind eye to the credit needs of small businesses, but things are looking up now. According to the March 2016 Biz2Credit Small Business Lending Index, monthly analysis of more than 1,000 small business loan applications on Biz2Credit.com, loan approval rates at major banks and institutional lenders […]

For eligible US home buyers, the VA loan may be the best mortgage choice for a purchase. Backed by the U.S. Department of Veterans Affairs and made possible by the GI Bill, the VA Loan allows no down payment, requires no mortgage insurance, and gives applicants access to flexible mortgage guidelines. Also, VA mortgage rates […]

GETTING approved for a mortgage loan is not easy. The level of information required is vast and the whole process takes a long time. That means it’s a process that should only be undertaken by well-organized people, advises Ciaran Phelan, chief executive of the Irish Brokers’ Association. “The level of information required is vast. Be […]

Last June saw an increase in the number of banks approving small business loan applications, compared to the same period last year, according to recent research from Biz2Credit, an online lending marketplace. The study showed that big banks – financial institutions with assets of more than $10 billion – approved 20% of loans to small […]