EDITOR’S CHOICEFree access to the best insights and insights – curated by our editors. Transportation Alliance Bank (TAB Bank) in Ogden, Utah, has a partnership with a fintech called EasyPay Finance that appears to advance the bank’s financial inclusion goal – it lends to people with low FICO scores who couldn’t get credit elsewhere – […]

Tag Archives: interest rates

By Adewale Sanyaolu The Federal Competition and Consumer Protection Commission (FCCPC), together with the Independent Corrupt Practices Commission (ICPC) and the National Information Technology Development Agency (NITAD), raided some platforms loan application for violation of consumer rights. Some of the companies attacked included GoCash, Okash, EasyCredit, Kashkash, Speedy Choice and Easy Moni. Leading the raid […]

“San Diego Mortgage Company – Equis Mortgage Group, LLC” Check out a San Diego Mortgage Company, called Equis Mortgage Group, LLC and a San Diego Mortgage Broker, David LePari, for all your mortgage and real estate needs with fast approvals and today’s low rates. today. We were looking for a San Diego mortgage company that […]

As efforts to implement a national rate cap stall, more states are considering banning consumer loans with annual percentage rates above 36%. New Mexico lawmakers recently approved a 36% rate cap, which would reduce the state’s current maximum APR by 175%. It now awaits the governor’s signature. Lawmakers in Rhode Island and Minnesota are considering […]

NEW YORK, Feb. 23 10, 2022 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, PC, a nationally recognized shareholder rights law firm, reminds investors that class action lawsuits have been filed on behalf of shareholders of FirstCash Holdings, Inc. (NASDAQ: FCFS), NRx Pharmaceuticals, Inc. (NASDAQ: NRXP, NRXPW), Clarivate Plc (NYSE: CLVT) and Bumble, Inc. (NASDAQ: BMBL). […]

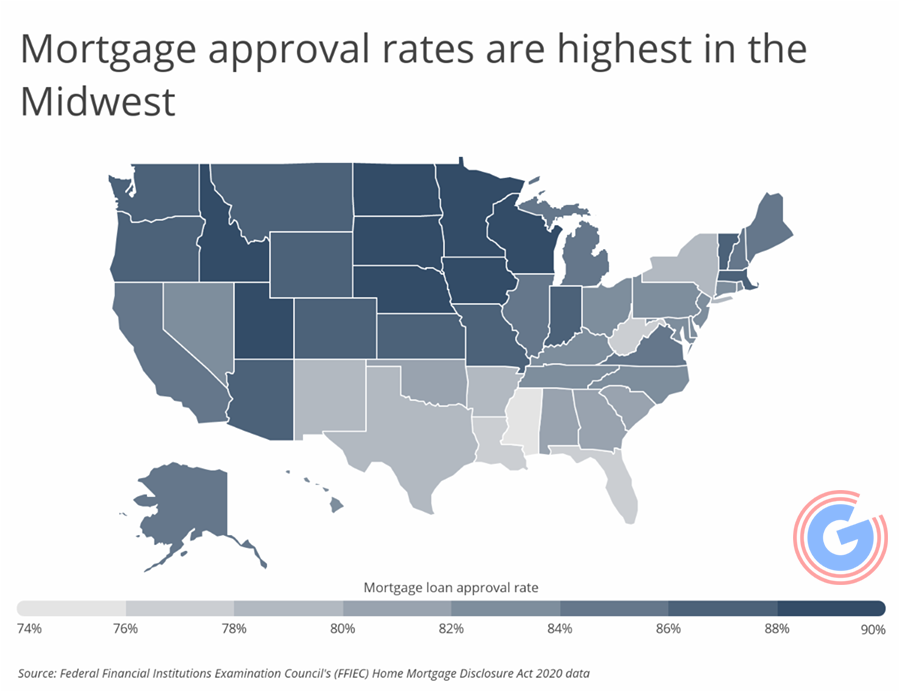

Buying a home during the pandemic has been a story of bidding wars, housing shortages and rapidly rising house prices. Despite this, historically low interest rates have encouraged millions of buyers to take out loans for new homes. According to mortgage data at the loan level of the Home Mortgage Disclosure Act (HMDA)86.3% of 2020 […]

A former Citigroup executive has raised about $9 million in a new round of seed funding for Paywallet, which extends credit to borrowers whose repayments come from their paychecks. Jacksonville, Florida-based Paywallet has piloted the concept for the past two years and plans to officially launch its product this year using a new round of […]

Photo credit: Freedomz / Shutterstock Buying a home during the pandemic has been a story of bidding wars, housing shortages and rapidly rising house prices. Despite this, historically low interest rates have encouraged millions of buyers to take out loans for new homes. According to mortgage data at the loan level of the Home Mortgage […]

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, who we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to herein as “Credible”. Whether you need money for home renovations, medical bills, […]

Loan approval rates from all types of lenders continue to rise in very small increments, according to the Biz2Credit Small Business Lending Index released Feb. 8. The report includes loan approval rates through January 2022. While approval rates are increasing, they are increasing in the same slow growth pattern that has existed for over a […]

Owning a business can be expensive and unexpected expenses tend to arise. For small business owners who need additional funds, small business loans could be a great option. There are many factors to consider when choosing a small business lender, such as eligibility requirements, loan amount options, and repayment terms. Small business owners can also […]

As the Federal Reserve raises interest rates this year, the trend of longer terms for new and used auto loans will likely accelerate, says Satyan Merchant, Senior Vice President and Chief Automobile Business at TransUnion. Borrowers seek to compensate for the rise in prices due to scarcity. “The term is really the only thing,” he […]

Rising home values have been a boon for homeowners, with almost half of mortgaged properties now considered “equity-rich” by Attom Data Solutions. For many homeowners with mortgages, a long-term financial goal is to have a home fully paid off. Thanks in part to this overcrowded residential market, nearly half of these homeowners are now closer […]

Connecticut businesses can apply for a physical disaster loan of up to $2 million for damage caused by Hurricane Ida through Jan. 28. The US Small Business Administration extended initial deadlines for businesses, private nonprofit organizations, landlords and tenants earlier this month. Hurricane remnants affected people across the state in the first two days of […]

Want to take a bite out of the real estate market? Before you get started, it’s important to maximize your financial situation and agree to increase your chances of getting approved for a home loan. You’ve put in the hard yards and saved enough for a security deposit, maintained a good credit rating, and signed […]

Real estate demand, especially in the residential segment, is recovering from the pandemic-induced slowdown. With Union Budget 2022-23 due on February 1, Ravindra Pai, MD of Century Real Estate expects to receive the following support from Modi government for the real estate segment:- 1. Creation of demand: “The government should allow second home purchases and […]

Shanks says she wrote to Trade Minister David Clark on December 16 to raise the issues and request a meeting, but is still awaiting a response. She wrote that the industry supported measures to protect consumers and understood that the changes were intended to do so. However, she said implementing the changes has led to […]

Although the approval percentages of banks and non-bank lenders (institutional lenders, alternative lenders and others) have risen steadily over the past 12 months, the rebound in small business lending is far from robust. Bank vault. (Photo by Dick Whittington Studio/Corbis via Getty Images) Corbis via Getty Images According to the latest Biz2Credit Small Business Loan […]

Approval percentages at large banks, small banks, institutional lenders, alternative lenders and credit unions are still about half of what they were in December 2019 NEW YORK, January 11, 2022 (GLOBE NEWSWIRE) – Small business loan approval percentages in big banks ($ 10 + in assets) fell from 14.2% in November to 14.3% in December, […]

The payday loans available in california online are among the most reliable option for those who require immediate cash. These loans are great for emergency situations such as repair of your car, unexpected medical bills as well as other financial issues that are too fast to be budgeted for. In actuality payday loans can save the day […]

MMost of us know that payday loans can be a horrifically expensive way to borrow money, with Wonga.com charging interest rates of 4,000% APR or more. But if you thought that was as bad as it gets, take a look at the loan agreement sent to Adam Richardson and the APR listed: a jaw-dropping 16,734,509.4%. […]

A bill allowing short-term loans at an annual interest rate of 204% creaked through the Arizona House of Representatives on Monday after intense lobbying to lift the 36% cap on usury laws of State. The 31-26 vote moves the debate to the Senate, where the bill died last month in committee but was revived as […]

NEW YORK — The nation’s federal financial watchdog said Wednesday it plans to scrap most of its regulations governing payday lenders. The move is seen as a victory for the payday loan industry, which has argued that government regulations could kill much of its business. But consumer groups say payday lenders exploit the poor and […]

What Might Change With US Online Payday Policy In 2021 If you need credit, it’s easy to fall victim to predatory lending. Online personal loan It is one of the easiest solutions you can take when you need cash immediately. It’s an option that even people with poor credit can use, so it seems attractive […]

Over the past few years, consumer credit protections have weakened due to a series of harsh attacks that have either dismissed outright or drastically reduced financial safeguards in the marketplace. But another consumer victory, spurred on by an outpouring of support from ordinary people, academics and bicameral lawmakers, signals an important step toward fair financial […]

Nevada corporate law is quite protective for directors and officers. Following the decision of the Supreme Court of Delaware in Smith vs. Van Gorkum, 488 A.2d 858 (1985), the Nevada legislature amended the statute to permit the exoneration of directors and officers. In 2001, the Nevada legislature took a big step forward by making exoneration […]

Do you want to drive a car? Own a house? Go to the University? Consolidate your debt? Finance your wedding? If you answered “yes” to any of these questions, chances are you will need to apply for a loan at some point. If you do, don’t feel bad; more than half of americans say they […]

Before the onslaught of Covid-19, when the markets were afloat, lenders gave up asking for protections in their loans. Now, there are signs that the situation is getting even worse, according to PitchBook’s third quarter report on private equity markets. Some recent transactions contain unusual terms or conditions that allow loans to be transferred to […]

Low interest rates have made refinancing student loans attractive to many borrowers, but it’s important to compare loan rates and terms to find the best deal. (iStock) If you want to pay off your student loans faster or simplify the loan repayment process, a student loan refinance may be the solution for you. A loan […]

While the ongoing lockdown is likely to impact your loan processing and disbursement due to limited staff and working hours, keeping these five tips in mind will definitely increase your chances of loan approval . Loans act as an invaluable bridge to bring us closer to achieving our financial goals, such as owning a house, […]

Thinking of applying for a personal loan? Here are the odds of you being approved. Personal loans can be a cost-effective way to borrow. The interest rate on personal loans is often lower than the rate you would pay on other types of debt, such as credit card debt. And you can use the personal […]

In a review of 30,000 small business loan applications sorted by industry over the past year, Biz2Credit surprisingly found that food service and accommodation businesses had the highest loan approval rates highest (51%) in 2018 compared to retail, healthcare, and professional and personal services. According to the study, food and lodging businesses, including hotels, caterers […]

The latest findings from Experian show that consumers continue to lengthen the terms of their car loan, which is a worrying trend.

/https://specials-images.forbesimg.com/imageserve/61df2808725bf2b5faa29ba1/0x0.jpg?cropX1=0&cropX2=3083&cropY1=247&cropY2=2303)